The Post Graduate Program in Banking and Financial Services (PGPBFS) is a specialized program designed to equip students with in-depth knowledge and practical skills required for the banking and financial services industry. The program covers key aspects such as banking operations, financial markets, risk management, regulatory frameworks, and digital banking trends. This diploma provides a strong foundation for individuals aspiring to build a career in banking, financial institutions, and fintech companies. The comprehensive curriculum covers banking, finance, and regulatory aspects with practical exposure through case studies, simulations, and industry projects. Students benefit from guest lectures and training sessions by industry experts while focusing on emerging trends like digital banking, fintech, and financial analytics. The program includes placement assistance and career guidance for job opportunities in the banking and financial sector.

English

Course Start Date:

Starting Soon

Application Deadline:

Closing Soon

Duration:

1 Year

₹ 27,000

₹ 30,000

Overview

This specialized Post Graduate Program in Banking and Financial Services is designed to equip students with in-depth knowledge and practical skills required for the banking and financial services industry. The program covers key aspects including banking operations, financial markets, risk management, regulatory frameworks, and digital banking trends. This diploma provides a strong foundation for individuals aspiring to build careers in banking, financial institutions, and fintech companies. The comprehensive curriculum ensures students gain practical exposure through case studies, simulations, and industry projects while learning from industry experts.

Why Postgraduate Diplomas?

This program is worth considering for career advancement in the banking and financial services sector. The flexible online format combined with potentially accredited curriculum makes it a valuable option for professionals. The program offers comprehensive coverage of banking, finance, and regulatory aspects with practical exposure through case studies and industry projects. Students benefit from guest lectures by industry experts and focus on emerging trends like digital banking, fintech, and financial analytics. The program includes placement assistance and career guidance for job opportunities in the banking and financial sector.

What does this course have to offer?

Key Highlights

Comprehensive curriculum covering banking, finance, and regulatory aspects

Practical exposure through case studies, simulations, and industry projects

Guest lectures and training sessions by industry experts

Focus on emerging trends like digital banking, fintech, and financial analytics

Placement assistance and career guidance for job opportunities in banking and financial sector

NAAC A+ accredited program with UGC recognition

Access to exclusive online scholarly resources and E-library facilities

Industry-aligned curriculum to enhance relevant competencies

Who is this programme for?

Graduates aspiring for careers in banking, investment management, and financial consulting

Working professionals in finance sector looking to upskill in banking regulations, credit analysis, and portfolio management

Entrepreneurs in financial services sector seeking to understand banking procedures, investment planning, and financial risk mitigation

Professionals seeking career progression in banking and financial institutions

Individuals wanting to enter the fintech industry with comprehensive banking knowledge

Minimum Eligibility

Bachelor's degree in any discipline from a recognized university.

Who is the programme for?

The admission process requires candidates to have a Bachelor's degree in any discipline from a recognized university. Academic structure spans one year with two semesters covering comprehensive banking and financial services curriculum. The program is designed to provide practical skills and industry knowledge essential for banking and financial services careers. The flexible online format allows working professionals to enhance their skills while continuing their current roles.

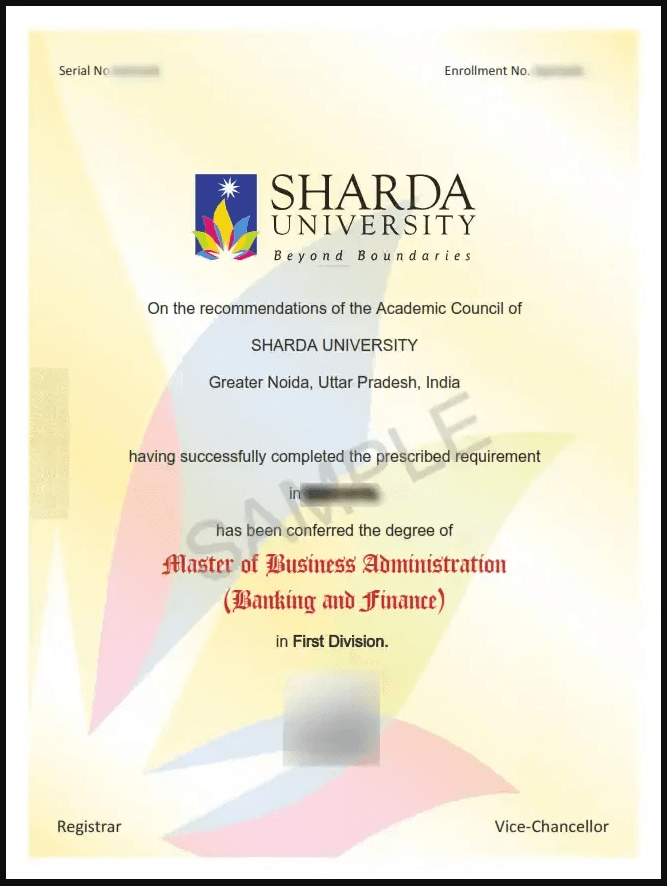

Here's a Glimpse of Your Degree

*Disclaimer: The image is for illustrative purposes only and may be subject to change at the discretion of Management.

Selection process

How to apply?

Curriculum

The curriculum is designed with industry-aligned content covering core banking and financial services disciplines. Students progress through two semesters covering foundational banking concepts, financial markets, risk management, and advanced topics in digital banking and fintech. The program integrates theoretical knowledge with practical skills through case studies, simulations, and industry projects. Guest lectures and training sessions by industry experts provide real-world insights and current industry trends.

There are 2 semesters in this course

Semester I covers Indian Financial System, Corporate and Retail Banking Products, Banking Principles & Operations, Accounting and Financial Statement Analysis, and Regulatory Framework in BFSI. Semester II focuses on Customer Relationship Management in BFSI, Marketing and Sales Management, Financial Management and Planning, Leadership & Business Ethics, and IT in Banking. The curriculum maintains balance between theoretical understanding and practical application, preparing students for diverse roles in banking, financial institutions, and fintech companies. The program emphasizes emerging trends including digital banking, fintech innovations, and financial analytics.

Semester I

Semester II

Programme Length

One-year program with flexible online format allowing anytime, anywhere learning. Students have round-the-clock access to live and recorded lectures, online forums, and peer groups. The program can be completed while balancing work and personal commitments through self-paced learning modules and convenient scheduling options. The compact duration makes it ideal for working professionals seeking quick skill enhancement.

Tuition Fee

The program offers excellent value with a total fee of ₹30,000 for the complete one-year program. This affordable pricing makes specialized banking education accessible to a wide range of students and professionals. The fee includes access to all learning materials, industry expert sessions, case studies, and placement assistance. Payment modes include net banking, debit/credit cards, and other online payment methods for convenient fee submission.

Fee Structure

Payment options

Financing options

Learning Experience

The program provides immersive online learning experience through state-of-the-art Learning Management System (LMS). Students engage with cutting-edge technology providing near face-to-face learning experience. Interactive features include chat and messaging, online forums, peer group discussions, and instant access to learning materials. The methodology combines live lectures, recorded sessions, case studies, simulations, and industry projects. Guest lectures and training sessions by industry experts enhance the learning experience with real-world insights.

University Experience

Students gain access to same extensive facilities as regular university students including comprehensive E-library resources, online scholarly videos, and academic support services. The program offers mentorship from experienced faculty and industry experts. Career advancement services and placement assistance are provided specifically for banking and financial sector opportunities. Alumni network provides ongoing professional connections and career opportunities across various banking institutions and fintech companies.

Testimonials

Testimonials and success stories are a testament to the quality of this program and its impact on your career and learning journey. Be the first to help others make an informed decision by sharing your review of the course.

Loading alumni...

About the University

Established in 2009, Sharda University is a private university located in Greater Noida, Uttar Pradesh, India. The university has emerged as a leading center for education, research, and innovation, with a strong focus on global education. It operates through 14 schools offering diverse programs across engineering, medical, dental, nursing, pharmacy, business, law, and other disciplines. The university is known for its international outlook, hosting students from 95+ countries and maintaining 250+ global academic partnerships.

#86

NIRF University Rank 2024

#219

QS Southern Asia Rank 2024

17000+

Total Students

Affiliation & Recognition

UGC

NAAC

PCI

Association of Commonwealth Universities

Career services

The Career Counseling and Development Centre (CCDC) at Sharda University provides comprehensive career support services. The center offers guidance for higher education, placement preparation, internship opportunities, and entrepreneurship guidance. It helps students with resume preparation, communication skills development, interview preparation, and business writing. The CCDC also conducts mock interviews and leadership development programs. The center acts as a bridge between academia and industry, helping students transition smoothly into their professional careers.

40LPA

Highest Package 2024

450+

Total Recruiters

100%

Placement Rate MBA

Top Recruiters

Course Start Date:

Starting Soon

Application Deadline:

Closing Soon

Duration:

1 Year

₹ 27,000

₹ 30,000

Frequently asked questions

Below are some of the most commonly asked questions about this course. We aim to provide clear and concise answers to help you better understand the course content, structure, and any other relevant information. If you have any additional questions or if your question is not listed here, please don't hesitate to reach out to our support team for further assistance.