The Financial Analysis Prodegree, developed in collaboration with KPMG India, is a comprehensive 120-hour skill-building program designed for professionals seeking expertise in financial analysis and investment banking. The program combines theoretical knowledge with practical applications, featuring masterclasses by KPMG experts, hands-on projects, and extensive career support.

Instructors:

English

Course Start Date:

Starting Soon

Application Deadline:

23rd Feb, 2026

Duration:

4 Months

₹ 84,999

Overview

The Financial Analysis Prodegree offers a comprehensive curriculum developed in partnership with KPMG India. This 120-hour program combines theoretical foundations with practical applications, featuring masterclasses by industry experts, real-world case studies, and hands-on projects. Students gain expertise in financial statement analysis, modeling, valuation, equity research, and transaction execution.

Why Business Finance?

The program stands out for its unique collaboration with KPMG, offering industry-aligned curriculum, practical skill development, and extensive career support. The course provides a perfect blend of academic rigor and real-world applications, supported by experienced faculty and industry practitioners.

What does this course have to offer?

Key Highlights

Industry-aligned curriculum with KPMG partnership

Masterclasses by KPMG experts

120 hours of comprehensive training

Real-world projects and case studies

Extensive career support and placement assistance

Industry certification

Flexible weekend schedule

Who is this programme for?

Finance professionals seeking career advancement

Aspiring investment bankers

Corporate finance professionals

Equity research analysts

Financial analysts

Professionals interested in valuation and M&A

Minimum Eligibility

Bachelor's degree

Profile-based selection

Who is the programme for?

The program follows a structured admission process evaluating candidates' academic background and basic finance knowledge. The curriculum is delivered through live online sessions on weekends, combining lectures, case studies, projects, and masterclasses.

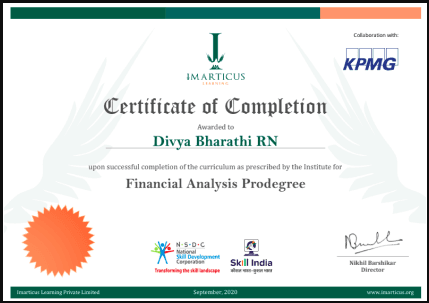

Here's a Glimpse of Your Degree

*Disclaimer: The image is for illustrative purposes only and may be subject to change at the discretion of Management.

Important Information

Selection process

How to apply?

Curriculum

The curriculum spans 12 comprehensive modules delivered over 4 months through weekend live sessions. Module 1 introduces financial analysis fundamentals and career landscape. Module 2 builds Excel proficiency for finance applications. Module 3 establishes accounting foundations including IFRS and Ind AS. Module 4 covers ratio analysis and financial consolidation. Module 5 teaches forecasting techniques for revenue, expenses, and capital expenditure. Module 6 focuses on investment banking-style financial modelling with Excel best practices. Module 7 delivers valuation methodologies including DCF, DDM, and relative valuation. Module 8 applies corporate strategy frameworks like Porter's Five Forces and BCG Matrix. Module 9 develops reporting skills using PowerBI and data visualization. Module 10 explores M&A execution and deal structuring. Module 11 trains participants in equity research and report writing. Module 12 integrates AI and automation tools including ChatGPT, Copilot, and Zapier for financial workflows.

There are 12 semesters in this course

The curriculum is structured into 12 progressive modules that build from fundamentals to advanced applications. Financial Analysis Fundamentals introduces the field and career opportunities in private equity, equity research, and investment banking. Excel for Finance develops essential data manipulation and analysis skills. Fundamentals of Accounting establishes the double-entry system, financial statements, and accounting standards. Ratio Analysis and Financial Consolidation teaches performance evaluation using profitability, liquidity, and solvency metrics. Forecasting Techniques covers revenue, operating expenses, depreciation, and tax modelling. Financial Modelling builds IB-standard models with scenario analysis and sensitivity testing. Valuation Methodologies includes DCF models, dividend discount models, and terminal value estimation. Corporate Strategy applies SWOT, PEST, Porter's Five Forces, and BCG Matrix through the Mahindra case study. Reporting and Data Visualization develops pivot tables, business charting, and PowerBI dashboards. M&A Execution covers deal documentation, due diligence, and synergy valuation. Equity Research teaches report writing and fundamental analysis using the Reliance Industries case. AI & Automation integrates GenAI tools for financial reporting, modelling, and workflow automation.

Module 1: Financial Analysis Fundamentals

Module 2: Excel for Finance

Module 3: Fundamentals of Accounting

Module 4: Ratio Analysis and Financial Consolidation

Module 6: Financial Modelling

Module 7: Valuation Methodologies

Module 8: Corporate Strategy and Industry Analysis

Module 9: Reporting and Data Visualization

Module 10: M&A Execution and Deal Structuring

Module 11: Equity Research and Report Writing

Module 12: AI & Automation in Finance

Programme Length

4 months with weekend classes

Whom you will learn from?

Learn from top industry experts who bring real-world experience and deep knowledge to every lesson. The instructors are dedicated to help you achieve your goals with practical insights and hands-on guidance.

Instructors

Expert

India’s youngest CFP in 2008, he has since built a distinguished career as a finance trainer and mentor. Over the years, he has earned the CFA Charter, delivered corporate training for leading organisations, and guided more than 12,000 professionals and students. Known for his ability to simplify complex financial concepts, he continues to inspire and shape aspiring finance professionals across industries.

Expert

Sakshi, an Associate Director with the CFO Advisory practice at KPMG, specializes in researching and implementing solutions to accounting issues for clients in the renewable energy sector. With over 9 years of experience, she has expertise in financial reporting, statutory audits, and training solutions across sectors such as renewable energy, infrastructure, media, publication, finance, IT, and chemicals.

Tuition Fee

The program fee is ₹84,999 inclusive of all taxes, representing significant value for a KPMG-affiliated certification. This investment covers 140+ hours of live instruction from KPMG practitioners, comprehensive learning materials, access to the online portal with recordings and resources, five capstone projects, joint certification, and placement assistance. The fee structure reflects the program's premium positioning as an industry-recognized credential that opens doors to high-growth finance careers. Compared to traditional degree programs or international certifications costing lakhs, this prodegree offers exceptional ROI through targeted skill development, practical application focus, and direct industry relevance. The all-inclusive pricing ensures transparency with no hidden costs, making financial planning straightforward for participants

Fee Structure

Payment options

Financing options

Financial Aid

Learning Experience

Students experience a blend of synchronous online learning through live weekend classes, interactive case discussions, and hands-on projects. The program includes masterclasses by KPMG experts, peer learning opportunities, and practical workshops.

University Experience

Students gain access to comprehensive online learning resources, including recorded lectures, presentation materials, case studies, and e-books. The program offers virtual networking opportunities and interaction with industry experts through regular masterclasses.

Word from the Directors

Gaurav Vohra

Partner, CFO Advisory at KPMG in India

The objective of the collaboration between Imarticus and KPMG in India is to bridge existing skill gaps and enhance job readiness for candidates so that they can be placed at global financial houses.

Testimonials

Testimonials and success stories are a testament to the quality of this program and its impact on your career and learning journey. Be the first to help others make an informed decision by sharing your review of the course.

Loading alumni...

About the University

The KPMG Learning Academy is a comprehensive educational initiative that brings together KPMG's subject matter expertise with learning design and technology capabilities. The academy delivers a range of off-the-shelf digital, blended, and classroom courses across various subjects through a secure online platform. It serves as a center of excellence housing thought leadership and best practices observed across client organizations. The academy offers specialized programs including post-graduate courses in accounting and auditing, sustainability training, independent director certification, and leadership development programs in partnership with Harvard Business Publishing

1,601,827

Total learning hours FY23-24

79

Average learning hours per person

Affiliation & Recognition

harvard business publishing

google cloud

university of cambridge

university of leeds

Faculties

These are the expert instructors who will be teaching you throughout the course. With a wealth of knowledge and real-world experience, they're here to guide, inspire, and support you every step of the way. Get to know the people who will help you reach your learning goals and make the most of your journey.

Instructors

Expert

India’s youngest CFP in 2008, he has since built a distinguished career as a finance trainer and mentor. Over the years, he has earned the CFA Charter, delivered corporate training for leading organisations, and guided more than 12,000 professionals and students. Known for his ability to simplify complex financial concepts, he continues to inspire and shape aspiring finance professionals across industries.

Expert

Sakshi, an Associate Director with the CFO Advisory practice at KPMG, specializes in researching and implementing solutions to accounting issues for clients in the renewable energy sector. With over 9 years of experience, she has expertise in financial reporting, statutory audits, and training solutions across sectors such as renewable energy, infrastructure, media, publication, finance, IT, and chemicals.

Career services

KPMG Learning Academy provides comprehensive career development support through various initiatives. The academy maps career development milestones to well-researched role-based learning maps, supporting professionals from onboarding through various transition periods. The learning ecosystem continuously evolves with changes in technology and skill requirements, offering some of the best learning options to participants. The academy provides flexibility to earn external certifications and access to Executive MBA programs from leading MBA institutes in India. Additionally, it offers specialized skill programs tailored to practice requirements, helping professionals deliver client expectations effectively

1,601,827

Total learning hours delivered

79

Average learning hours per person

Top Recruiters

Course Start Date:

Starting Soon

Application Deadline:

23rd Feb, 2026

Duration:

4 Months

₹ 84,999

Frequently asked questions

Below are some of the most commonly asked questions about this course. We aim to provide clear and concise answers to help you better understand the course content, structure, and any other relevant information. If you have any additional questions or if your question is not listed here, please don't hesitate to reach out to our support team for further assistance.