This three-year Online BBA program in Banking Financial Services and Insurance Management at DPU-COL is designed for learners advancing in banking and finance fields. The program provides comprehensive understanding of banking principles, financial services, and insurance practices in India. Students master Investment Analysis, Portfolio Management, Entrepreneurship, Insurance Principles, Legal Framework of BFSI, Risk Management, Personal Finance, Investment Banking, Taxation Planning, and Advanced Banking Technology through practical applications, internships, and projects.

English

Course Start Date:

Starting Soon

Application Deadline:

Closing Soon

Duration:

3 Years

₹ 1,45,400

Overview

This comprehensive three-year Online BBA program in BFSI Management provides deep understanding of banking principles, financial services, and insurance practices. Students explore Investment Analysis, Portfolio Management, Entrepreneurship, Insurance Principles, BFSI Legal Framework, Risk Management, Personal Finance, Investment Banking, Taxation Planning, and Advanced Banking Technology. The program emphasizes practical applications through internships and projects, preparing graduates for the digitalized private and public sector banking environment.

Why BBA (Bachelor of Business Administration)?

Choose this program to advance in the high-demand banking and finance sector with comprehensive BFSI knowledge. The program prepares you for lucrative careers in banking, financial services, and insurance through industry-oriented curriculum covering modern banking technology and digital financial services.

What does this course have to offer?

Key Highlights

Flexible schedule with accessible online LMS

Expert faculty with banking and finance experience

Interactive virtual classrooms and discussion forums

Updated industry-oriented curriculum

Career support with job placement assistance

Innovative learning tools including simulations and quizzes

Who is this programme for?

Students interested in banking and finance careers

Working professionals in financial services seeking advancement

Entrepreneurs planning financial ventures

Graduates seeking roles in banking and insurance

Candidates interested in investment and portfolio management

Minimum Eligibility

Bachelor's degree in Computer Science/Computer Applications/IT with minimum 50% marks and 1 year work experience

Who is the programme for?

The program follows a semester-wise structure with 10+2 or equivalent qualification requirement. Students complete six semesters over three years with BFSI specialization in the final year. The curriculum emphasizes banking principles, financial services, insurance practices, and modern banking technology preparing students for digitalized financial sector opportunities.

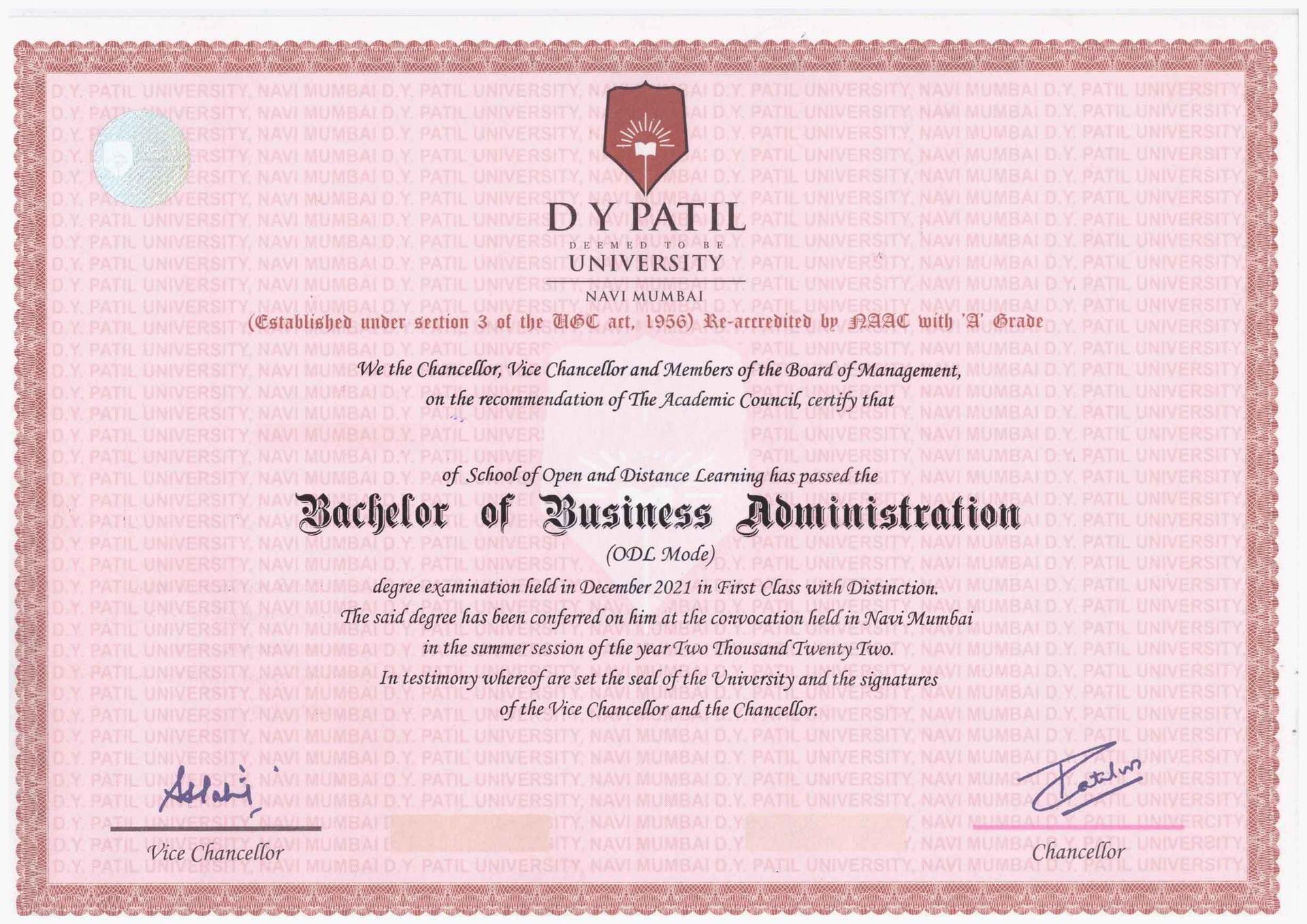

Here's a Glimpse of Your Degree

*Disclaimer: The image is for illustrative purposes only and may be subject to change at the discretion of Management.

Selection process

How to apply?

Curriculum

The curriculum spans six semesters covering banking fundamentals, financial services, insurance management, investment analysis, portfolio management, risk management, taxation planning, and advanced banking technology. Students gain comprehensive understanding of BFSI sector through theoretical knowledge and practical applications including internships and projects.

There are 6 semesters in this course

Semester 1 covers Fundamentals of Management, Basics of Marketing, Accounting, Economics, Environmental Awareness, and Business English. Semester 2 includes Organizational Behaviour, Indian Economy, Marketing Management, Business Environment, Indian Banking System, and Soft Skills. Semester 3 focuses on Human Resource Management, Banking Operations, Psychology, Research Methodology, Business Law, and advanced Soft Skills. Semester 4 introduces Management Information System, Entrepreneurship, International Business, Quantitative Techniques, Financial Management, and Digital Marketing. Semester 5 emphasizes Production Management, Business Ethics, Marketing of Financial Services, SMEs, Banking Law & Practice, and Insurance & Risk Management. Semester 6 concludes with Project Management, Event Management, E-Commerce, Financial Securities & Markets, Investment & Portfolio Management, and Project Work.

Semester 1

Semester 2

Semester 3

Semester 4

Semester 5

Semester 6

Programme Length

3 years full-time with option to extend to 4 years for additional flexibility

Tuition Fee

The total program fee is INR 1,45,400 for Indian students over 3 years with semester-wise payment structure. International students pay $2,800 for the 3-year program. A scholarship of Rs 5,000 is available for students making full fee payment in two transactions within 15 days.

Fee Structure

Payment options

Financial Aid

Learning Experience

Students experience interacting e-learning sessions through realtime engaging virtual classes, workshops and live chats with faculty members, webinars featuring industry experts, group discussions using live chats, and pre-planned annual and weekly academic planners. The platform incorporates innovative learning tools including video lectures, simulations, quizzes, and discussion forums.

University Experience

DPU-COL offers UGC approved, NAAC 'A++' grade, and AICTE accredited programs. Students benefit from the university's strong reputation in online education, comprehensive support services, and industry connections for banking and finance career opportunities.

Testimonials

Testimonials and success stories are a testament to the quality of this program and its impact on your career and learning journey. Be the first to help others make an informed decision by sharing your review of the course.

Loading alumni...

About the University

Established in 2003 as a Deemed-to-be-University, Dr. D. Y. Patil Vidyapeeth is a leading private institution in Pune, India. Located on a 43-acre campus, the university has grown from a single medical college to multiple constituent institutions. DPU is recognized for its excellence in medical, dental, biotechnology, and management education, maintaining high standards in teaching, research, and healthcare delivery.

9000

Total Students

70 Countries

International Representation

11

NIRF Medical Rank

Affiliation & Recognition

-1729486099394.svg)

University Grants Commission

National Assessment and Accreditation Council

Association of Indian Universities

Career services

The Career Guidance and Placement Team provides comprehensive support through dedicated placement cells across various institutes. Services include pre-placement talks, recruitment drives, and industry interactions. The institution maintains strong connections with leading employers, organizing campus interviews and placement activities throughout the academic year.

86.61%

MBA Placement Rate

21 LPA

Highest Package MBA

6.60 LPA

Average Package MBA

Course Start Date:

Starting Soon

Application Deadline:

Closing Soon

Duration:

3 Years

₹ 1,45,400

Frequently asked questions

Below are some of the most commonly asked questions about this course. We aim to provide clear and concise answers to help you better understand the course content, structure, and any other relevant information. If you have any additional questions or if your question is not listed here, please don't hesitate to reach out to our support team for further assistance.